Bangladesh Embraces Market Dynamics Under IMF Suggestion

In a significant shift, Bangladesh Bank is poised to adopt a more market-oriented approach to interest rates and exchange rates, aligning with recommendations from the International Monetary Fund (IMF). Governor Abdur Rouf Talukder revealed plans to introduce flexible interest rates and exchange rates during a discussion at the Pan Pacific Sonargaon Dhaka. These changes, part of Bangladesh’s ongoing economic evolution, aim to foster a more dynamic financial landscape.

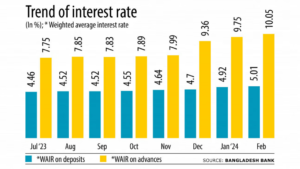

Under the proposed changes, interest rates would no longer be bound by fixed or band rates but would instead fluctuate based on demand and supply, allowing banks greater autonomy in setting rates. This move signals a departure from the previous system, which capped lending rates at 9 percent and deposit rates at 6 percent.

Additionally, Bangladesh Bank is exploring the adoption of a “crawling peg” method for exchange rates, allowing for gradual currency depreciation or appreciation. These measures represent a significant departure from the previous fixed exchange rate regime and underscore Bangladesh’s commitment to embracing market dynamics.

While these changes hold promise for a more flexible and responsive financial system, experts caution that challenges lie ahead. High inflation rates and concerns over falling foreign exchange reserves remain key issues that must be addressed. Former central bank governors and financial experts emphasized the need for prudent monetary and fiscal policies to ensure stability and growth.

As Bangladesh navigates these transitions, the role of the central bank in maintaining discipline and autonomy becomes paramount. Experts stress the importance of insulating monetary policy from political influence and fostering a conducive environment for sustainable economic growth.

While uncertainties loom, Bangladesh’s willingness to adapt to changing economic realities reflects a forward-thinking approach aimed at bolstering resilience and fostering prosperity in the face of evolving global dynamics.

![Mumtaz Zahra Baloch, spokesperson for Pakistan's Foreign Ministry, says the country believes in constructive dialogue with the US [Courtesy of Pakistan Ministry of Foreign Affairs]](https://southasiancorrespondent.com/wp-content/uploads/2024/06/pak-1-390x220.jpg)