Bangladesh Govt’s bank borrowing nearly doubles in Jul-Sep

The government has nearly doubled its borrowing from commercial banks in the first three months of the current fiscal year compared to the equivalent period last year, primarily due to lower revenue collection.

Bankers also attributed the increased government borrowing to high interest rates on treasury bills and bonds, which have become an attractive investment option for banks as the private sector’s demand for new loans has reduced.

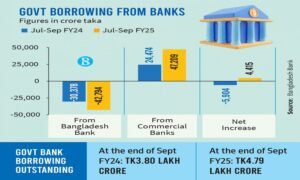

According to data from the Bangladesh Bank, the government borrowed Tk47,209 crore from banks through the sale of treasury bills and bonds with varying maturities from July to September. In the same period last year, the government borrowed Tk24,474 crore from banks, reflecting an increase of approximately 93% over the year.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, told The Business Standard, “The government is unable to collect revenue according to its targets, and the expected foreign funds have not materialised as of September. As a result, the government has been compelled to borrow from the banking sector.

“Bankers are lending to the government through treasury bills and bonds due to low demand for private sector loans,” he added. “Currently, the demand for loans has decreased because new investments are not being made, leading banks to invest their liquid assets in Treasury bills and bonds.”

The seasoned banker also noted that interest rates on treasury bills and bonds have recently declined by 5 to 10 basis points as the government’s borrowing appetite has decreased.

The Bangladesh Bank stated that the government is primarily repaying its debt to the central bank by borrowing from commercial banks. In the first three months of the current fiscal year, the government repaid Tk42,794 crore to the central bank, compared to Tk30,378 crore repaid during the same period last year.

According to central bank data, the government’s net borrowing from the banking sector increased by Tk4,415 crore during the July-September period, a decrease from Tk5,904 crore in the previous year.

A senior official at the central bank said, “The money market regulator is reducing the money supply in the market as part of its contractionary monetary policy. This process involves withdrawing liquid funds from commercial banks back to the central bank, which effectively helps control inflation.”

Additionally, the number of days for borrowing money through repos has been reduced; banks can now borrow from the central bank through repos only on two working days a week, down from the previous practice of borrowing on every working day, he added.

Zahid Hussain, former lead economist at the World Bank’s Dhaka Office, told TBS that the government’s borrowing has exceeded the fixed limit due to overdrafts from the central bank. He noted that the government has borrowed from commercial banks and then repaid those loans to the central bank.

With revenue collection falling short of targets, borrowing from the banking sector must be increased to cover operating costs, including salaries for government employees and interest on loans, he continued.

Highlighting the inconsistency between the policy rate and the interest rates on Treasury bills and bonds, the economist stated, “There should be an adjustment to align the policy rate with the interest rates on Treasury bills and bonds. Otherwise, banks will exploit the central bank’s funds for profit.”

He emphasised the importance of adhering to regulations when using loans from the central bank, explaining that if a bank faces liquidity problems and borrows, using that borrowed money for business purposes can create complications. The central bank should enhance its oversight in these matters.

He also suggested that the government needs to reform its expenditure management and revenue mobilisation processes to reduce reliance on banking sector borrowing and to increase income.