Bhutan’s Bitcoin asset value crosses USD 1B

Capitalising on the recent Bitcoin (BTC) price surges, Bhutan cashed out 367 BTC worth about USD 33.5 million through major cryptocurrency exchange, Binance, on November 14.

Bitcoin price rose to more than USD 90,000 for 1 BTC. As of yesterday, 1 BTC was equivalent to USD 90, 799.

This latest sale marks the second significant Bitcoin sale for Bhutan in recent weeks for USD 66 million upon Bitcoins reaching USD 70,000 per BTC. In recent weeks, Bhutan sold BTC worth almost USD 100 million.

The Chief executive officer of the Druk Holding and Investments (DHI), Ujjwal Deep Dahal, said: “We hold assets in the form of Bitcoin and we started mining those assets in 2019 with our green hydropower.”

The country continues to be one of the bigger government Bitcoin holders with 12, 206 Bitcoin under the DHI, worth about USD 1.11 billion. This is equivalent to over 35 percent of the country’s 2023 GDP at USD 3.02 billion or Nu 249.39 billion.

As of September this year, Bhutan’s Bitcoin holdings was reported at 13, 011 BTC worth USD 780.49 million, the fourth largest Bitcoin holder globally. At that time, one BTC was equivalent to over USD 60,000.

With the recent cash out, Bhutan is ranked fifth among countries holding BTC, after the United States, China, the United Kingdom, and Ukraine.

Unlike other countries where BTC are more common from reported law enforcement asset seizures, Bhutan mines Bitcoin with abundant hydroelectric resources.

Bhutan has established mining facilities at multiple locations, with the largest facility situated at the former Education City Project site. Bitcoin’s production cost is influenced by several factors, including electricity prices, project capital costs, and the difficulty rate of mining.

The fourth Bitcoin halving was completed in April 2024 and the next Bitcoin halving is expected to occur in 2028, meaning miners receive 50 percent fewer bitcoins for verifying transactions. The block reward will drop to 1.5625 new BTC from 3.125 new BTC in 2028.

Bitcoin halving occurs once every 210,000 blocks, roughly every four years until the maximum supply of 21 million Bitcoins has been generated by the network until around 2140.

In addition to the already Bitcoin mining centres in the country, Bhutan also aims to expand its mining capacity to 600 megawatts by 2025 in partnership with Bitdeer.

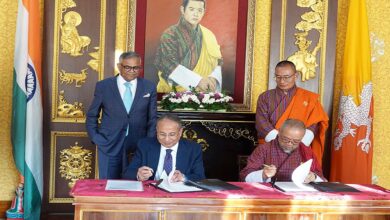

On May 3 last year, Bitdeer, a leading Nasdaq-listed technology company, and DHI announced a partnership for a USD 500 million project to develop environmentally sustainable, carbon-free digital asset mining operations.

The first project, a 100MW Bicoin mine in Gedu began operations in mid-2023. A 500MW project at the Jigmeling Industrial Park in Gelephu is expected to be operational by mid-2025.

According to a World Bank report, Bhutan has invested USD 539 million in cryptocurrency mining operations over the last two fiscal years, from July 2021 to June 2023. This substantial investment has contributed to a significant decline in the country’s reserves.

During the period from July 2021 to June 2022, reserves dropped by 34.7 percent, falling from USD 1.27 billion to USD 832.9 million. By June 2023, reserves further decreased to USD 573 million, less than half of what they were in June 2021.

In terms of trade, Bhutan imported IT equipment valued at Nu 4 billion in 2023 and Nu 11.91 billion in 2022. In 2021, the country imported IT equipment worth Nu 4.33 billion.

The Bank reported that DHI financed its cryptocurrency mining investments through loans from the Royal Monetary Authority to accelerate the country’s digital transformation and diversify its economy.