Sri Lanka’s Budget Revenue Target Continues to Elude: Verité Research Report

Despite government projections for economic recovery, Sri Lanka faces another year of revenue shortfall, marking the 33rd consecutive year of missing its budget revenue target, according to the latest ‘State of the Budget Report 2024’ released by Verité Research.

The report, a cornerstone of economic analysis in Sri Lanka, provides an objective assessment of fiscal estimates, shedding light on discrepancies between government projections and actual outcomes. With a track record of accuracy surpassing official forecasts, the report serves as a crucial tool for informed decision-making in the country.

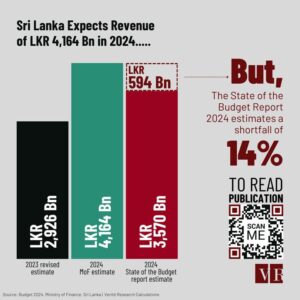

Sri Lanka’s struggle to meet revenue targets stems from persistent overestimation of tax revenue, a trend observed since 1991. Despite the government’s ambitious revenue projection of LKR 4,164 billion for 2024, Verité Research predicts a 14% shortfall, estimating revenue at only LKR 3,570 billion.

The report identifies the overestimation of revenue from Value Added Tax (VAT) and various taxes including corporate income tax, personal income tax, Social Security Contribution Levy (SSCL), and Customs import duty as contributing factors to the projected shortfall.

Of particular concern is Sri Lanka’s staggering interest-cost-to-revenue ratio, the highest in the world. Despite government efforts to reduce this ratio to 64%, projections indicate it may exceed 70%, jeopardizing macroeconomic stability and debt sustainability. This discrepancy raises doubts about Sri Lanka’s ability to adhere to its economic recovery plan, as outlined in agreements with the International Monetary Fund (IMF).

As Sri Lanka grapples with fiscal challenges, the ‘State of the Budget Report’ underscores the urgent need for recalibration of revenue projections and implementation of sustainable economic policies to achieve long-term stability and growth.

![The United Kingdom removed the people who lived in the Chagos Islands to establish the military base. The displaced Chagossians have taken legal action arguing the UK illegally maintains sovereignty over the islands [file: Mike Corder/AP Photo]](https://southasiancorrespondent.com/wp-content/uploads/2024/07/sri-390x220.jpg)